Floodplain maps are essential tools for real estate investors in flood-prone areas, offering detailed risk assessments based on historical data, advanced modeling, and satellite imagery. These maps help navigate borrowing requirements, insurance policies, and construction methods, mitigating disaster risks while maximizing returns. Key insights include understanding zone designations (e.g., Zones A and V), analyzing historical flooding patterns, engaging with local experts, and considering climate change impacts to make informed, sustainable investment decisions. Staying abreast of updated floodplain maps and adopting adaptive development strategies can enhance property value and security in evolving climates.

In the realm of real estate investment, understanding flood risks is paramount for informed decision-making. Floodplain maps play a pivotal role in gauging these risks, offering investors invaluable insights into areas prone to inundation. However, navigating these resources can be a complex task, often shrouded in jargon and technicalities. This trusted report aims to demystify the floodplain map process, providing investors with a comprehensive guide to deciphering these critical tools. By the end, readers will possess the knowledge to make sound investments, mitigating potential losses and capitalizing on opportunities in today’s dynamic market.

Understanding Floodplain Maps: A Key Resource for Investors

Floodplain maps are critical resources for investors navigating real estate markets, particularly those in areas prone to flooding. These detailed, data-driven tools illustrate the extent of flood risks across a specific region, serving as a cornerstone for informed investment decisions. Understanding floodplain maps is essential for assessing property value, risk management, and ensuring compliance with regulatory requirements, especially for floodplain map borrower considerations.

These maps, created and maintained by government agencies like the Federal Emergency Management Agency (FEMA), leverage historical data, advanced modeling techniques, and satellite imagery to depict areas prone to flooding from various sources—riverine, coastal, or storm events. They offer a granular view of floodplains, including specific risk levels and depths, enabling investors to make strategic choices. For instance, investors can identify properties located outside designated flood zones, opt for more secure, elevated construction designs, or consider insurance adjustments based on precise floodplain data.

By integrating floodplain maps into their investment strategies, stakeholders can mitigate risks associated with natural disasters while maximizing returns. Staying informed about floodplain map borrower requirements and utilizing these resources effectively can help navigate potential challenges posed by regulatory bodies. Investors should consult local authorities, engage in thorough due diligence, and consider the evolving nature of climate change impacts on flood patterns to make sound investment choices in flood-prone areas.

Decoding Map Data: Identifying High-Risk Areas

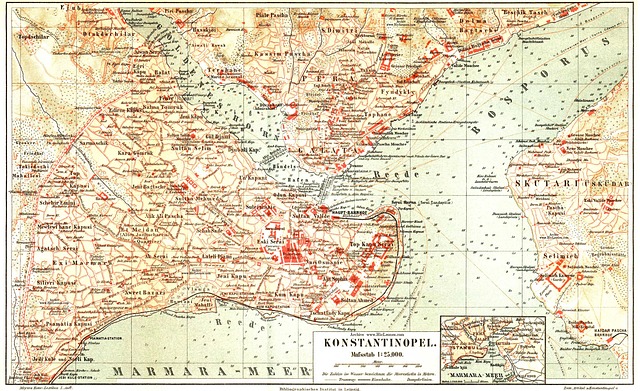

Decoding a floodplain map is a crucial step for investors looking to navigate the complexities of modern real estate. These maps, provided by regulatory agencies, offer critical insights into areas prone to flooding, which is essential knowledge for any borrower or investor in high-risk zones. The data presented on these maps goes beyond simple water bodies; it identifies specific floodplain areas based on historical and scientific data, helping lenders assess risk accurately. For instance, a study by the Federal Emergency Management Agency (FEMA) has shown that nearly 20% of properties in certain urban areas are located within special flood hazard zones, emphasizing the significance of these maps in informed decision-making.

When analyzing a floodplain map, investors should pay close attention to zone designations. Each zone is categorized based on its potential for flooding, with zones A and V indicating the highest risk. Zones A represent areas subject to periodic flooding while zones V denote areas at the greatest risk, often in direct alignment with rivers or coastal regions. Understanding these classifications is paramount as it directly impacts mortgage requirements. Lenders will often assess properties within high-risk zones differently, implementing stricter lending criteria to mitigate potential losses. Borrowers should be prepared for more stringent loan terms, higher interest rates, and potentially larger down payments when investing in such areas.

To ensure a comprehensive evaluation, investors should consider integrating these maps into their due diligence process. Cross-referencing property data with floodplain maps can reveal valuable insights that might otherwise go unnoticed. For example, a property’s historical flooding records, if any, can be verified against the map data, ensuring accuracy in risk assessment. This proactive approach not only protects lenders and borrowers but also enables investors to make more informed choices, potentially avoiding future financial pitfalls associated with high-risk floodplain areas.

Assessing Risk: Implications for Real Estate Investments

Floodplain maps are critical tools for assessing risk, particularly for real estate investors navigating today’s market. These detailed geographic representations identify areas prone to flooding, offering invaluable insights into potential property risks. For investors, understanding floodplain map borrower requirements is essential to make informed decisions and mitigate financial exposure. According to the Federal Emergency Management Agency (FEMA), nearly 10% of U.S. landmass is considered in a special flood hazard area (SFHA), highlighting the significance of these maps for risk management.

When evaluating investment opportunities, investors should scrutinize local floodplain maps to comprehend historical and current flooding patterns. This data guides them in identifying safe havens versus high-risk zones. For instance, areas with recurring flash floods or those situated near rivers prone to seasonal overtopping present distinct challenges compared to elevated terrains. Flood insurance requirements, a direct outcome of these maps, play a pivotal role in borrower assessments. Lenders typically mandate flood insurance for properties located within SFHAs, with premiums varying based on regional risk levels as indicated by the floodplain map data.

Moreover, investors can leverage advanced mapping technologies that offer dynamic and interactive views, enabling them to analyze potential flood risks more accurately. These tools allow users to layer various data sets, including historical flooding events, topographical features, and infrastructure vulnerabilities, onto a single platform. By combining this contextual information with local zoning regulations and development plans, investors gain a comprehensive understanding of a property’s resilience against flooding. This proactive approach not only reduces the likelihood of financial loss but also positions investors as responsible stakeholders committed to making sustainable real estate decisions.

Mitigating Losses: Strategies for Safe Investing

Investing in real estate requires a keen understanding of the risks inherent to the location. One critical aspect often overlooked but carrying significant weight is the floodplain map. This tool, mandated by federal and local authorities, delineates areas prone to flooding, guiding both developers and investors alike. By meticulously studying these maps, investors can implement strategies that mitigate potential losses, ensuring their investments stand firm even during the most severe weather events.

The floodplain map borrower requirements vary depending on jurisdiction, but they all serve the same purpose: to protect lenders and investors from financial peril. These requirements often dictate the type of infrastructure and construction methods allowed in designated areas, with stricter regulations applying to zones at higher risk. For instance, in coastal regions, building codes might mandate elevated structures or robust floodproofing measures to safeguard against regular storm surges. Investors should not only familiarize themselves with these guidelines but also consult with professionals who can advise on the feasibility and cost-effectiveness of adhering to them.

A practical approach for investors is to conduct a thorough analysis of historical flooding data in conjunction with the floodplain map. This involves examining past events, their intensity, and frequency. According to the Federal Emergency Management Agency (FEMA), areas with a 1% annual chance of flooding—often reflected on these maps as Special Flood Hazard Areas (SFHA)—have a significant risk of inundation. By understanding these risks, investors can strategically choose properties in less vulnerable zones or implement advanced flood mitigation systems. For instance, property in higher ground within the same region may present a safer investment, even if it means slightly lower returns compared to floodplain areas.

Additionally, engaging with local experts and staying informed about regulatory changes is vital. As climate change intensifies global weather patterns, flooding risks evolve, prompting updates to floodplain maps. Investors who stay abreast of these developments can adapt their strategies accordingly, ensuring their investments remain secure in a changing landscape. This proactive approach not only protects against financial losses but also positions investors as forward-thinking leaders in the market, attracting both lenders and tenants with robust risk management practices.

Future-Proofing Properties: Adaptability in Flood-Prone Regions

In regions prone to flooding, understanding and navigating the complexities of local floodplain maps is paramount for investors looking to future-proof their real estate holdings. These detailed maps, which designate areas at risk from flooding, play a crucial role in mitigating risks and ensuring the long-term viability of properties. For borrowers seeking financing in such areas, comprehending these maps is not merely desirable—it’s essential. The floodplain map borrower requirements often influence loan eligibility, insurance policies, and investment strategies, shaping decisions that can impact both financial health and environmental sustainability.

Consider a scenario where a coastal city experiences increasing frequency and intensity of storms. A recent update to the local floodplain map reveals expanded high-risk zones due to rising sea levels and changing weather patterns. Borrowers with properties in these areas may face stricter lending criteria, including higher interest rates or reduced loan amounts. However, this also presents an opportunity for adaptive development strategies. Investors can collaborate with architects and engineers to design buildings that not only withstand but also utilize flood-related challenges, such as integrating sustainable water management systems or constructing elevated structures. By embracing these adaptations, investors can create resilient assets that maintain their value even amidst changing environmental conditions.

Data from recent studies underscores the growing importance of these maps in shaping investment decisions. A study analyzing historical flooding data and property values in flood-prone regions found that well-adapted properties not only retained their market value but often appreciated faster than their less resilient counterparts. This trend is particularly notable in areas where governments have implemented robust flood mitigation measures, such as improved drainage systems or natural barrier projects. By staying informed about evolving floodplain maps and adopting adaptive practices, investors can navigate these regions with confidence, ensuring their investments remain secure and potentially lucrative in the face of an ever-changing climate.