Floodplain maps, based on historical and scientific data, visually represent flood risk zones crucial for real estate professionals. These maps guide property value assessment, insurance, and regulatory compliance, impacting loan approval processes. Key insights include:

1. Map Interpretation: Essential skill for agents, brokers, and lenders to understand risk levels indicated by colors (red: highest, lighter: lower).

2. Regulatory Compliance: Maps dictate development permissions and insurance requirements, with FEMA-backed NFIP policies mandatory in high-risk areas.

3. Risk Mitigation: Professionals use maps to assess flood risks, enhance property value, and minimize financial losses for smart investment decisions.

4. Data Access: Latest maps available from local governments or FEMA online, with mapping tools enabling detailed analysis of specific addresses.

In the dynamic realm of real estate, understanding flood risks is paramount for informed decision-making. Navigating the complexities of floodplain maps has emerged as a critical aspect of this process, especially with climate change exacerbating water-related hazards. However, deciphering these maps presents a challenge for professionals, often leading to oversights or misjudgments. This article offers an authoritative guide, equipping real estate experts with actionable insights into floodplain mapping. We demystify key components, explain their significance, and provide practical strategies for integration into daily operations. By embracing this knowledge, professionals can enhance client safety, mitigate financial risks, and contribute to resilient communities.

Understanding Floodplain Maps: A Basics Guide for Real Estate

Understanding floodplain maps is a critical component of due diligence for real estate professionals, especially when navigating areas prone to flooding. These maps, often referred to as flood hazard or risk maps, visually represent areas at risk of flooding based on historical and scientific data. They serve as essential tools for assessing property value, insuring against risks, and meeting regulatory requirements. For instance, a recent study by the National Oceanic and Atmospheric Administration (NOAA) highlighted that nearly 14 million people in the U.S. live in high-risk flood zones, underscoring the importance of these maps in informed decision-making.

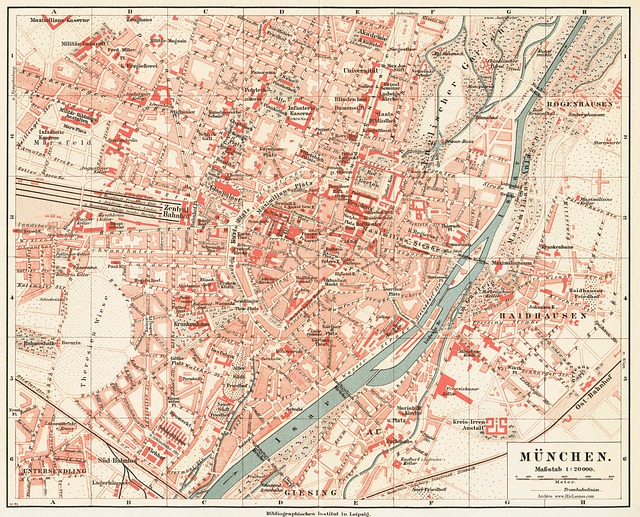

Floodplain maps provide detailed information on zones subject to flooding events, ranging from minor inundations to catastrophic floods. They are typically categorized using the Flood Insurance Rate Maps (FIRMs) developed by the Federal Emergency Management Agency (FEMA). These maps are regularly updated to account for changes in topography, land use, and climate patterns. Real estate agents, brokers, and lenders should be adept at interpreting these maps, as they directly impact borrower requirements. For instance, mortgage lenders often insist on flood zone determinations before approving loans in areas deemed high risk, ensuring compliance with federal regulations like those set by the Federal Housing Administration (FHA).

When assessing a property, real estate professionals should scrutinize the latest available floodplain maps. They can be obtained from local governmental entities or through FEMA’s online resources. Mapping tools and data sets enable users to zoom in on specific addresses or areas of interest, providing detailed information about flood risks. This knowledge allows agents to guide buyers, helping them make informed choices. For example, properties located within Special Flood Hazard Areas (SFHA) may require more stringent insurance coverage and higher deductibles, influencing the overall cost of ownership. By understanding these nuances, professionals can facilitate transparent discussions and ensure all parties are cognizant of potential flood-related challenges.

Interpreting Data: How to Read and Analyze Flood Zones

Understanding how to interpret data on a floodplain map is an essential skill for real estate professionals. These maps, critical tools in assessing property risks, detail areas prone to flooding based on historical and scientific data. When analyzing a floodplain map, consider the various zones identified—from low-risk to high—and their implications for potential buyers or borrowers. Zones are often color-coded, with each hue representing a specific flood hazard level.

For instance, a zone painted in red typically signifies areas with a 1% annual chance of flooding, indicating the highest risk. Conversely, lighter colors denote lower risks. It’s crucial to relay this information accurately to clients or lenders—a detail that can significantly impact borrower requirements. Lenders, for example, often have specific guidelines regarding properties in high-risk zones, which may include higher interest rates or special insurance mandates. A thorough understanding of these maps allows professionals to guide borrowers on realistic expectations and necessary precautions.

Furthermore, beyond zone identification, pay close attention to the map’s scale and legend. These elements provide precise definitions for each floodplain category, ensuring accurate interpretations. Regularly update your knowledge on mapping technologies and software to stay current with advancements in data collection and analysis. By mastering these skills, real estate professionals can ensure they’re offering clients informed decisions based on reliable, up-to-date information from the floodplain map, thereby facilitating transparent transactions and fulfilling borrower requirements.

Legal Implications: Zoning Regulations & Insurance Requirements

Navigating the legal landscape of real estate involves a keen understanding of zoning regulations and insurance requirements, especially when properties are located in areas susceptible to flooding. The floodplain map plays a pivotal role in this regard, dictating where development is permitted and restricting activities that might amplify environmental risks. For professionals operating within these parameters, compliance with local ordinances and federal guidelines regarding the floodplain map borrower requirements is non-negotiable.

Zoning regulations specific to floodplains often limit construction types and intensities, ensuring built environments can withstand potential inundation events. These restrictions may prohibit certain structures, dictate building heights, or mandate specific floodproofing measures. Real estate professionals must familiarize themselves with these local laws, as violations can lead to significant penalties and legal repercussions. For instance, a borrower undertaking development in a high-risk area without adhering to prescribed floodplain regulations could face costly delays, fines, or even the reversal of project approvals.

Insurance requirements are another critical aspect influenced by the floodplain map. Property insurance policies typically exclude coverage for damage caused by flooding unless specific flood insurance is procured. Lenders often mandate that borrowers in flood-prone areas obtain Federal Emergency Management Agency (FEMA)-backed National Flood Insurance Program (NFIP) policies, ensuring they meet current floodplain map borrower requirements. These policies not only safeguard lenders but also provide property owners with the financial security needed to recover from flooding events, a significant consideration for real estate professionals navigating high-risk locations.

Real estate experts advising clients in floodplain areas should emphasize proactive measures like obtaining accurate floodplain maps, conducting thorough risk assessments, and exploring available insurance options. This comprehensive approach ensures not only legal compliance but also the protection of investments and the safety of occupants, fostering a more resilient built environment despite the challenges posed by flood-prone landscapes.

Mitigating Risk: Strategies for Smart Property Investment Decisions

For real estate professionals, understanding floodplain maps is crucial when mitigating risk and making smart property investment decisions. These maps, created and maintained by federal, state, or local agencies, detail areas prone to flooding based on historical data and hydrological models. They serve as essential tools for assessing and managing flood risks, which can significantly impact property values and borrower requirements.

By consulting a floodplain map, lenders and investors can avoid or mitigate potential losses associated with high-risk areas. For instance, properties located within Special Flood Hazard Areas (SFHAs), identified on these maps, often require specific insurance policies—like Flood Insurance Policies (FIPs)—as conditions for financing. These policies are designed to cover the additional risks that standard homeowners’ insurance doesn’t address. According to the Federal Emergency Management Agency (FEMA), over 20% of properties in the U.S. are located in SFHAs, underscoring the map’s practical significance.

Additionally, floodplain maps can help professionals identify areas suitable for development or redevelopment. Properties outside these high-risk zones may offer more flexible financing options and higher property values. For example, a real estate developer considering a project near a river might use a floodplain map to ensure the site isn’t within a designated flood plain, thus avoiding stringent borrower requirements and potential construction delays due to flooding concerns. By proactively assessing flood risks using these maps, professionals can make informed decisions, enhance property value, and minimize potential financial losses.