Floodplain maps are essential tools for real estate professionals, providing critical insights into flooding risks. These data-driven resources guide loan eligibility, insurance requirements, and development planning. With nearly 10 million US properties in high-risk zones, lenders increasingly incorporate map data into risk assessments, impacting borrowing terms. Accurate interpretation empowers professionals to advise borrowers, ensure compliance, and foster resilient communities. Comprehensive due diligence includes verifying property location on the latest maps, analyzing historical flood data, and consulting local officials.

In the realm of real estate, understanding one’s environment is paramount for informed decision-making. Among the critical tools at professionals’ disposal is the floodplain map—a vital resource for gauging areas prone to flooding. With natural disasters posing an increasingly significant risk, comprehending these maps is no longer a nicety but an imperative. This article aims to demystify floodplain maps, offering real estate experts a comprehensive guide to interpretation and application. By the end, you’ll be equipped to navigate these complex landscapes with enhanced confidence and precision.

Understanding Floodplain Maps: A Basic Guide for Real Estate Professionals

Floodplain maps are critical tools for real estate professionals navigating the complexities of property acquisition and development. These detailed, data-driven resources visually represent areas prone to flooding, providing essential insights into potential risks associated with specific locations. Understanding floodplain maps is paramount for informed decision-making, as they directly impact loan eligibility, insurance requirements, and strategic planning.

For instance, a recent study by the Federal Emergency Management Agency (FEMA) revealed that nearly 10 million properties in the United States are located in high-risk flood zones, underscoring the significance of these maps in guiding development and investment decisions. In areas prone to flooding, lenders often require borrowers to obtain flood insurance as a condition for financing, emphasizing the importance of these maps in the loan approval process. The floodplain map borrower requirements can vary depending on local regulations and the severity of the flood risk; therefore, professionals must stay abreast of evolving guidelines to ensure compliance.

Real estate agents play a pivotal role in guiding clients toward suitable properties by integrating floodplain map analysis into their services. By presenting accurate, up-to-date information, agents can help buyers make informed choices, avoiding potentially devastating financial losses associated with flooded properties. Moreover, understanding the nuances of floodplain maps allows developers to design resilient infrastructure, mitigating future risks and fostering sustainable growth in vulnerable areas. Staying proficient in interpreting these maps is a strategic necessity for all real estate professionals aiming to thrive in an ever-changing market.

Interpreting Data: How to Read and Analyze Floodplain Maps Effectively

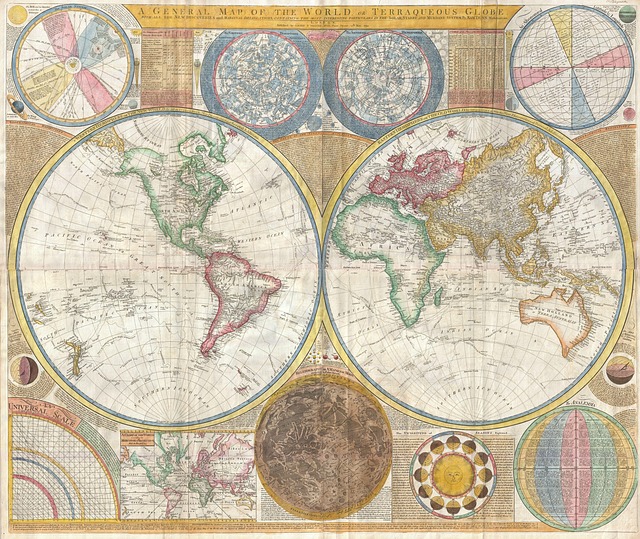

Understanding how to interpret data on a floodplain map is a critical skill for real estate professionals. These maps, detailed depictions of low-lying areas prone to flooding, offer invaluable insights into property risks. By analyzing the information they provide, lenders and borrowers alike can make informed decisions about property acquisition and financing.

Floodplain maps, maintained by local, state, or federal agencies, utilize color coding and zones to designate flood risk levels. Darker hues often indicate higher risks while lighter areas represent lower probabilities. Within these zones, specific data points such as depth of water during past floods, frequency, and velocity offer further nuances. For instance, a map might show that a particular area experiences shallow flooding occasionally but is prone to rapid water flow during severe storms. This information is crucial for assessing potential damages and determining appropriate insurance coverage.

When examining a floodplain map borrower requirements come into play. Lenders are increasingly incorporating these maps into their risk assessments. A property located in a high-risk zone might require more stringent lending terms, including higher interest rates or larger down payments to mitigate perceived risks. Borrowers should be prepared to understand and discuss these implications with lenders. For example, a buyer considering a home in a Zone A floodplain might need to demonstrate increased financial reserves to secure a mortgage. Engaging with knowledgeable professionals who can interpret the map data accurately is essential for navigating these complexities successfully.

Understanding how to read and analyze floodplain maps empowers real estate professionals to make sound decisions. It allows them to guide borrowers, ensure transparency in loan processes, and ultimately contribute to more resilient communities. Staying updated on mapping advancements and local regulations related to floodplain zones remains paramount for maintaining expertise in this critical aspect of property transactions.

Navigating Regulations: Using Floodplain Maps for Safe Property Transactions

Navigating Regulations: Using Floodplain Maps for Safe Property Transactions

Floodplain maps are critical tools for real estate professionals engaged in property transactions. These detailed maps, maintained by local, state, or federal agencies, illustrate areas prone to flooding based on historical and scientific data. Understanding and utilizing floodplain maps is essential for ensuring safe and compliant property acquisitions. For instance, a recent study showed that nearly 9 million properties are located in high-risk flood zones across the United States, underscoring the importance of integrating floodplain map borrower requirements into every transaction.

When assessing a potential investment, real estate professionals must consult these maps to gauge flood risks accurately. A property situated within a designated floodplain may face stricter lending guidelines and insurance requirements. Lenders, including federal housing administration (FHA) and veterans affairs (VA) lenders, often mandate specific measures to mitigate flood risks, such as raising structures above base flood elevation or installing flood protection systems. Failure to comply with these floodplain map borrower requirements can lead to loan denials, delayed closings, or increased insurance premiums for borrowers.

Expert advice emphasizes the need for comprehensive due diligence when dealing with flood-prone properties. Real estate professionals should not only verify the property’s location on the latest floodplain maps but also analyze historical flood data and consult with local building code officials to understand applicable regulations. By integrating these steps into their processes, they can facilitate smoother transactions, protect borrowers’ interests, and minimize potential financial losses stemming from unforeseen flood risks. This proactive approach ensures that every deal is executed with confidence and in full compliance with relevant floodplain map borrower requirements.